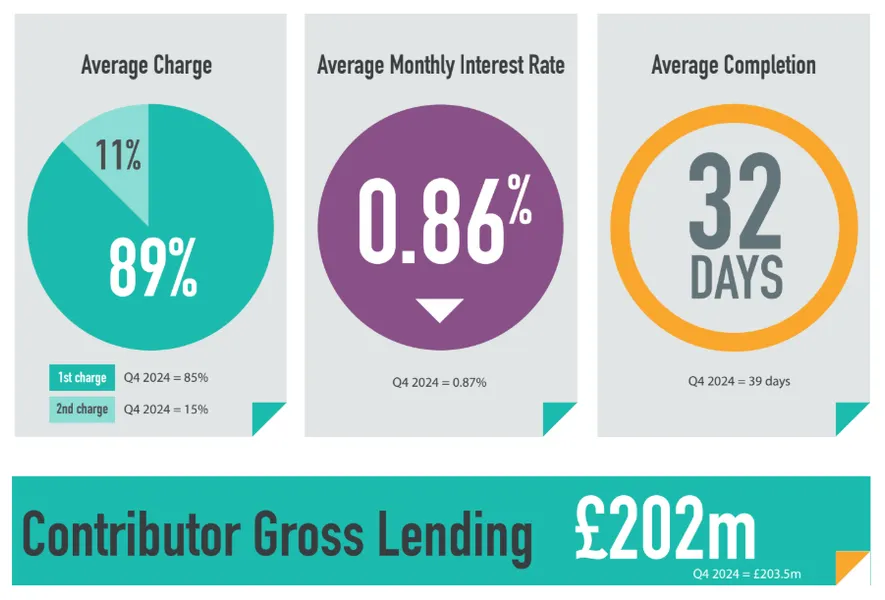

The latest Bridging Trends data reveals bridging loan activity has remained relatively stable in the first quarter of 2025. Contributors recorded total gross lending of £202 million with faster completion times despite increased volumes, and a notable rise in investment purchases.

Key Points for Q1 2025:

- Faster completion times – historic best performance ever recorded

- Gross contributor lending remains stable

- Investment purchase was the most popular use of bridging loans

- Demand for first charge bridging loans increased

The bridging finance market demonstrated remarkable resilience in Q1 2025, with applications increasing slightly from the previous quarter. Despite increased volume of applications, the average completion time decreased significantly by 7 days, from 39 days in Q4 2024 to 32 days in Q1 2025 - the lowest it has ever been since Bridging Trends launched in 2015. This demonstrates increased competency in processing loans and a more efficient lending environment.

The market recorded a significant increase in investment purchases, which rose from 13% in Q4 2024 to 23% in Q1 2025. Investment purchases now account for the largest portion of loan purposes in Q1 2025, and it suggests a strong response to stamp duty purchase ahead of the March 31st deadline.

Heavy refurbishment was the second most popular purpose for obtaining bridging finance in Q1, rising to 11% from 9% in the previous quarter and climbing to the 8th position on the search criteria from 14th position in Q4. Re-bridge loans also saw a modest rise from 8% to 10% which indicates borrowers’ optimism about favourable market conditions and are willing to service their loans for another 12 months.

Data provided by Knowledge Bank revealed a demand for regulated bridging as it remained the top criteria search made by UK bridging finance brokers in Q1. The proportion of regulated loans stayed the same at 44% of total lending, with unregulated loans also staying at 53%. Additionally, the average loan-to-value (LTV) came in at 55.40% in Q1, dropping slightly from 55.70% in Q4. The average term remained at 12 months for the 14th consecutive quarter.

Raphael Benggio, Director of Bridging at MT Finance comments:

“The Bridging Trends Q1 2025 data shows remarkable market stability. The uptick in investment purchases, from 13% to 23%, suggests a strong link to stamp duty considerations, demonstrating borrowers’ keen awareness of these opportunities. The resultant decrease in completion time, where a surge in activity could have potentially strained processing times, represents the sector's enhanced efficiency, showing how quickly lenders can support the market. We expect continued sector stability and favourable market conditions throughout 2025.”

Benjamin Peace, Bridging & Development Finance Specialist at Brightstar Financial comments:

"Bridging finance continued to evolve in Q1 2025, setting a new benchmark for speed and responsiveness. Despite an increase in applications, average completion times dropped by a full week - from 39 to 32 days - the fastest since Bridging Trends began tracking the data in 2015. This progress reflects sharper underwriting, greater lender agility, and a broader shift toward a more efficient, borrower-focused market."

Shane Chawatama, Sales Director at Knowledge Bank comments:

"The significant rise in interest for ‘lend against land property’ climbing to 7th in Q1 2025 from 22nd in Q4 2024, alongside development bridging entering the top 10, suggests increasing appetite for early-stage and land-based development. Similarly, interest in ‘new build flats/apartments’ surged upwards, jumping to 38th from 99th. With the race towards the stamp duty Q1 deadline, this may point to brokers fast-tracking certain cases to capitalise on potential savings, which highlights the versatility of the bridging market."

To view the Bridging Trends Q1 2025 infographic, please visit www.bridgingtrends.com