The mutual has commissioned new research which shows that more than nine in ten (95%) parents of school-aged children (5-17) think it is important for their children to experience financial education and 89 percent think it should be taught in schools, yet only a quarter (24%) talk to their children about the subject once a week or more.

Parents talked to their children more regularly about a range of important topics than they talked about financial education, including mental health and wellbeing, healthy eating and diet, unhealthy habits (such as alcohol, tobacco, drugs), road safety, water safety, online safety and relationships.

On average, parents thought children should start learning about money management from around nine years old and two-thirds (66%) thought they should start learning about money management before they turn 10. However, research shows that children form money attitudes and habits at a young age. By age three, children can develop basic money concepts and by age seven many of their money habits, including the ability to plan and delay gratification are already set.

Almost all (91%) parents said they would be confident talking to their child about money management, with most (80%) agreeing that they would be confident talking about saving money, but this number reduced significantly when it came to confidently talking about key skills such as budgeting (68%) and recognising the difference between needs and wants (62%). Just over half (56%) said they would feel confident to teach their children about avoiding debt and only 43% would feel confident teaching their children about credit.

Seven in ten parents (70%) said they use personal experience to teach their children about money. This far exceeds the second most popular resource, financial apps (29%). Other resources include online content such as YouTube videos (27%), books (26%), professional advice (20%), and social media influencers (13%). But an overwhelming majority (89%) thought financial education should be taught in school.

Chris Irwin, director of savings at Yorkshire Building Society said: “This research shows that parents recognise that financial education is incredibly important, but they are juggling many different priorities when it comes to talking to their children about life skills. Although most recognise that children should start learning about money during primary school, many may not realise that attitudes and behaviours start developing at a very early age, and habits can form by the age of seven.

“We can see that most parents lean on personal experience to teach their children about money, meaning that those from less financially-savvy families could be at a disadvantage, and we can also see how parents’ confidence dips when talking about important, but more complex topics such as debt and credit.

“We hope that the Government will increase the focus on financial education in schools – and make it mandatory for all pupils across the country so no child misses out on developing important life skills relating to money.”

In 2024 the Society submitted recommendations into the Government’s Curriculum and Assessment review, which included mandatory financial education for all children, including for primary aged children in England. The report’s final recommendations are due in Autumn.

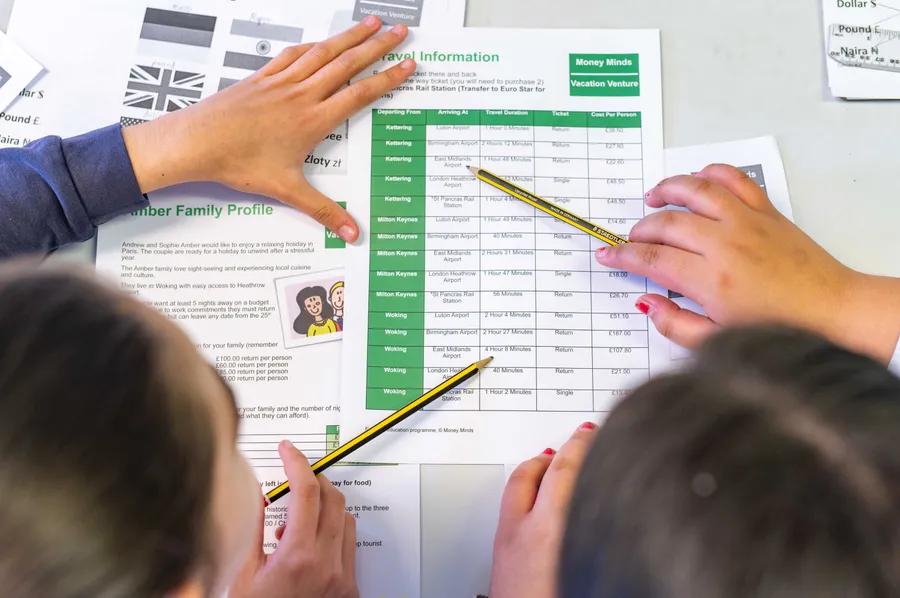

Since 2015, Yorkshire Building Society has supported teachers in the delivery of financial education. Last year over 16,000 children and young people across the UK participated in lessons from its Money Minds programme, including 457 from the Scarborough Bridlington and Whitby area. For parents, teachers and 11-19 year olds, the Money Minds online platform offers free resources covering topics such as keeping money safe, budgeting, making good choices, lending and borrowing, fraud and scams, what employers want, and relationships and money.